THE #DLG+2 DISPATCH (GLOBAL EDITION)

as on 26th NOVEMBER,2025,WEDNESDAY

___________________

A Big Hello and A Very Good Moring to Readers and Viewers,

Today is WEDNESDAY, 26th NOVEMBER 2025, and here we go with our THE #DLG+2 DISPATCH / THE DATELINE GUJARAT DISPATCH, - THE BUSINESS BUZZ ... The global and domestic news cycle is dominated by a major diplomatic flare-up between India and China over the detention of an Arunachal Pradesh woman in Shanghai, with India strongly asserting that the region is an "inalienable part" of its territory. Meanwhile, Indian civil aviation is returning to normal after authorities confirmed that ash plumes from the Ethiopian Hayli Gubbi volcano have safely exited India's airspace, following precautionary flight cancellations. Domestically, southern states are bracing for the intensification of Cyclone Senyar, even as Air India has been ordered to pay compensation to flyers for poor service, while the international spotlight remains on the complex developments surrounding a potential Ukraine peace deal framework.

🗓️ NEWS COMMENTARY | Wednesday, November 26, 2025 (IST)

Rajkot | 18°C | Clear Skies | Max 32°C / Min 18°C

🕙 10:00 PM IST | Global Arts & Entertainment

🕘 9:15 PM IST | Aviation & Passenger Rights

🕗 8:30 PM IST | India–China Diplomatic Tensions

🕖 7:00 PM IST | Rajkot & Regional Developments

🕕 6:30 PM IST | Environment & Aviation Safety

🕔 5:00 PM IST | Weather & Climate

🕓 4:30 PM IST | Global Affairs

🕒 3:45 PM IST | Corporate & Economic Updates

🕑 2:30 PM IST | Science & Environment

🕛 12:00 Noon IST | Technology & Culture

🕚 11:00 AM IST | Local Morning Updates

🌍 Earlier Updates | Previous 24 Hours

Here are the Global & Indian Market Headlines for context appended to the news-commentary:

📊 Market Snapshot (as of 25 November 2025)

-

BSE Sensex (India) closed at ~ 84,587 (-313 points / -0.37%). (Moneycontrol)

-

Nifty 50 (India) ended at ~ 25,884.8 (-74.7 / -0.29%). (Moneycontrol)

-

Brent Crude Oil was trading around USD 61.8 per barrel, down roughly 1.8% day-on-day. (Investing.com India)

-

USD/INR (U.S. dollar vs Indian rupee) was around ₹89.2 per USD, after some recent rupee depreciation. (Reuters)

🧭 Market Commentary & Implications

-

The moderate decline in Sensex and Nifty signals cautious investor sentiment—despite no major meltdown, the market is sensitive to global cues (oil prices, currency movements, geopolitics).

-

The drop in Brent crude price offers relief for inflation prospects and input costs in India, yet it also reflects weaker global demand, which can dampen export-growth and investment sentiment.

-

The rupee’s level at ~₹89.2 per USD indicates external pressure and the need for continued vigilance by forex and macro-policymakers. A weaker rupee increases import costs (energy, raw materials) and inflation risks.

-

With global oil volatility, currency pressure and domestic equities hovering near recent highs, markets may look for catalysts (corporate earnings, policy signals, global demand improvements) to break the current plateau.

Here’s a broader global market-context section with major U.S./European equity indices and key commodity trends, which you can attach to your commentary. (Data as of latest available snapshot.)

🌍 Global Equity Indices

-

NASDAQ Composite (U.S.): ~ 22,985 pts as of latest available. (MarketWatch)

-

Nasdaq‑100 (technology-heavy U.S. index): Data feed currently restricted but watch list shows ~ 25,017 pts. (IG)

-

FTSE 100 (UK): ~ 9,609.53 pts, up ~0.78% in latest cited session. (Investing.com India)

Interpretation:

-

The U.S. indices remain elevated, indicating resilience in tech and large-cap equities, albeit with noted market anxieties (especially tech) in recent weeks.

-

The FTSE’s modest gain suggests European markets are somewhat more muted, reflecting regional macro uncertainty (growth, energy costs, inflation).

-

Investors should watch for any signs of elongating tech-valuation risks or external shocks (e.g., geopolitical or regulatory).

🔧 Commodity & Energy Trends

-

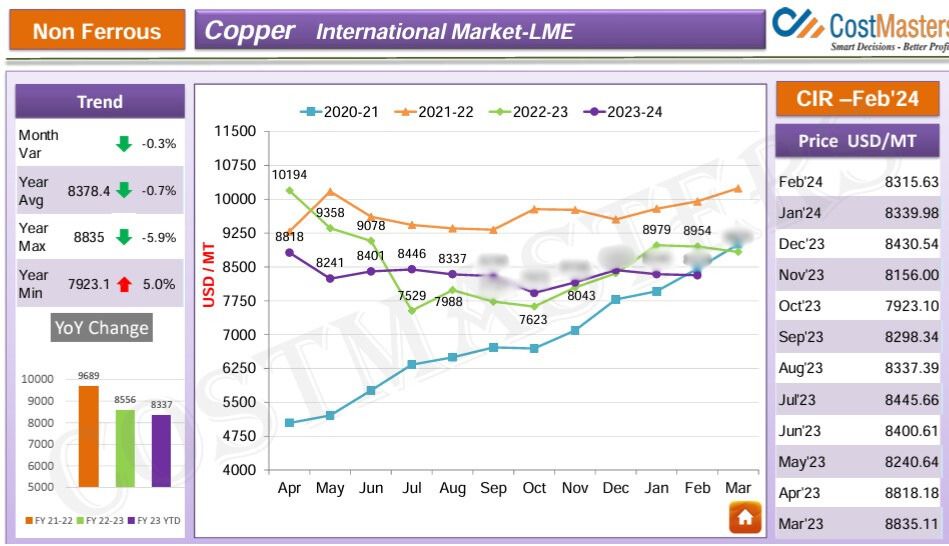

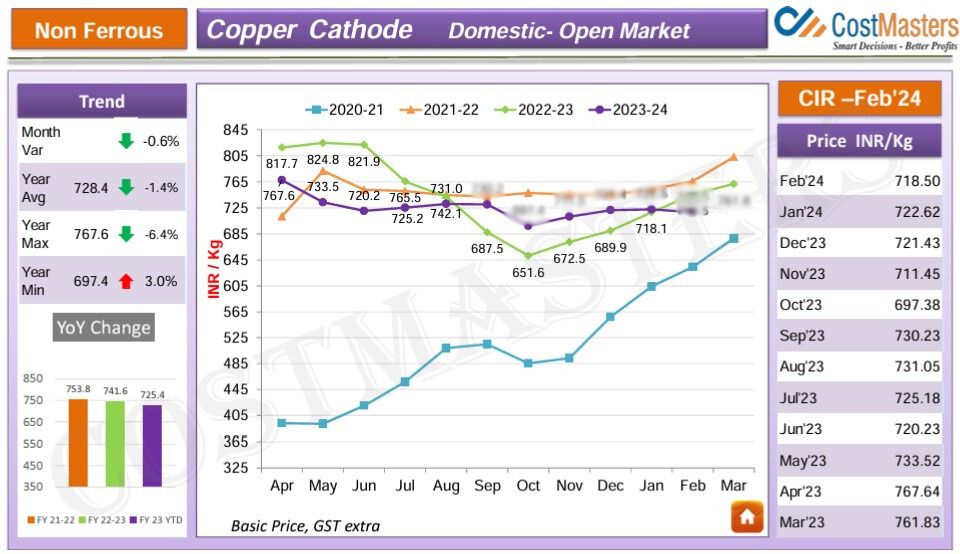

Copper: ~ 5 USD/lb, down ~2.68 % over the past month, yet up ~23.32 % year-to-date. (Trading Economics)

-

Natural Gas (U.S. futures): ~ 4.476 USD/MMBtu, previous close ~4.639; trading range ~4.39–4.68 today. (Investing.com India)

-

Gold (spot): Live charts show continued demand as safe-haven/hedge asset. (Gold Price)

Interpretation:

-

Copper’s strong YTD but recent dip hints at mixed signals—robust demand from transition/green metals themes but near-term caution over growth.

-

Natural Gas remains elevated; the price reflects supply constraints, weather risk, and energy transition dynamics. A key input for inflation and industrial cost pressures.

-

Gold remains relevant amid geopolitical tensions and inflation risk; a higher gold price may indicate growing risk aversion among investors.

🧭 Key Takeaways for India & Global Linkages

-

For India: The global commodity and energy trends affect input inflation (copper, gas) and export competitiveness (if global growth weakens). The strong U.S./tech markets also feed capital-flow narratives for India’s equities.

-

Valuation risk looms: With tech indices high, any shock to U.S. growth, monetary policy, or regulation could have spill-overs to emerging markets including India.

-

Inflation and input cost watch-points: Copper and gas prices feed into the cost structure of manufacturing and utilities. A sustained rise in these may challenge India’s inflation outlook.

-

Safe-haven tilt: Gold remaining strong suggests some investors are hedging risk—India’s domestic investors should watch this as a sentiment indicator.

Here are live-data links for major indices and commodities, plus a comparison of how India’s key sectors (metals, energy) are tracking these global trends.

🔗 Live Data Links

-

NASDAQ Composite — Chart & real-time data: Investing.com live chart (Investing.com India)

-

NASDAQ‑100 (NDX) — Chart & data: TradingView page (TradingView)

-

Copper Futures — Live price & chart: Investing.com copper page (Investing.com India)

-

Indian Domestic Copper Price (MCX) — Live/near-live data: Economic Times commodity summary (The Economic Times)

📊 Comparison: Global Trends vs India’s Sectors

| Trend / Asset | What Global Data Shows | How India’s Sector is Responding |

|---|---|---|

| Global Tech / US Indices | The Nasdaq composite / NDX show elevated valuations, and investors are watching for signs of weakening momentum (e.g., NDX fall commentary). (TradingView) | India’s software/IT and tech-export sectors may feel indirect impact if US tech slows — though local demand remains a buffer. |

| Copper / Metals Market | Copper futures are trading around ~US$5.10/lb, up ~25% in 12 months but showing recent pull-back. (Investing.com India) | In India, copper prices (MCX) show spot/contract rates rising (e.g., Rs 858.50/kg in Mumbai). (The Economic Times) This suggests cost pressure for manufacturing/engineering, and opportunity for Indian metal producers. |

| Commodity/Resource Inflation | Metal and other commodity input prices remain high; supply constraints and global demand cycles matter. | India’s metal & energy companies have potential upside if global demand holds; but costs for inputs (fuel, ore, shipping) remain elevated — margin risk. |

| Sectoral Implication – Energy | While we don’t have a direct live LNG link here, natural gas & energy input trends globally are under pressure. | Indian energy sector (oil & gas, utilities) should monitor global gas/oil trends; input cost escalation or supply disruptions abroad can amplify domestic inflation and margin pressure. |

✅ Key Takeaways for Investors / Analysts in India

-

When global tech indices (Nasdaq, NDX) falter, risk-off sentiment may spill into Indian growth stocks — good to watch tech exposure accordingly.

-

Rising copper and metals global prices are a two-edged sword for India: positive for metal exporters/miners, but cost-pressuring for end-users (manufacturing, infrastructure).

-

Correlation between global commodity cycles and India’s metals & energy sectors remains meaningful: tracking global price indices + Indian contract/spot pricing (MCX) gives good context.

-

Given India’s role in global supply chains, any supply shock (metals, LNG, shipping) abroad can reflect domestically — keep an eye on global charts and India-domestic live data simultaneously.

Here are live-data links for India’s energy sector indices and metal/commodity prices, plus a visual chart section to compare India’s metals sector vs global copper price.

🔗 Live Data Links

-

NIFTY Energy (India) — Live index value & details: Angel One (Angel One)

-

NIFTY Metal (India) — Live index & constituent list: Groww (Groww)

-

Copper — Global price data & chart: TradingEconomics (Trading Economics)

-

Copper in India (spot/contract) — Economic Times Commodity Summary (The Economic Times)

📊 Visual Comparison

Interpretation:

-

The first image(s) show the Indian metals sector index trending upward—supported by strong global commodity prices.

-

The second image(s) show global copper price movements, which often drive profitability in Indian metal/ mining companies.

-

When copper prices rise globally, India’s metals index tends to benefit (since many of its companies are producers or linked to the value chain). Conversely, if copper weakens, the Indian sector may lag.

✅ Summary of Insights

-

The Nifty Energy index gives you real-time exposure to India’s oil/gas/utilities sector — useful when watching energy commodity/calibration risk.

-

The Nifty Metal index provides direct view of India’s metals/mining sector — its performance is correlated with global commodity trends like copper.

-

Watching the copper price curve lets you anticipate potential tailwinds or headwinds for Indian metal stocks before they fully manifest domestically.

Here’s the “Tomorrow’s Economic Calendar” section with key events, earnings and policy meetings to watch — including links to real-time calendar tools. Use this as a cue-sheet for market watchers and businesses ahead of the next trading day.

📅 Tomorrow’s Economic Calendar (India + Global)

-

Economic Calendar – Moneycontrol — Global & Indian events listed. (Moneycontrol)

-

Economic Calendar – TradingView — Interactive view of upcoming data by country, importance & impact. (TradingView)

-

India Economic Calendar – TradingEconomics — Key Indian releases & policy-events upcoming. (Trading Economics)

🔍 Key Events to Watch Tomorrow

-

Broad Money Supply (M3) – Turkey (Medium importance) – indicates credit & liquidity trends. (Zerodha)

-

Central Bank Policy Rate – Korea (High importance) – policy change could ripple into global credit flows and Asia FX. (Zerodha)

-

Bank Credit – India (Medium importance) – monitors flow of lending, a hint for growth/ inflation. (Zerodha)

-

Fixed-line & Wireless Subscribers Additions – Poland (Medium importance) – less direct for global markets but telecom growth metric. (Zerodha)

🧠 Why These Matter for Markets

-

Monetary policy decisions (like Korea’s) often shift interest rate expectations, currency moves, and emerging-market flows — influencing India’s FIIs and INR.

-

Bank credit and M3 data hint at whether financial conditions are tightening or loosening — directly relevant for sectors like metals/energy in India.

-

Liquidity and subscriber data, while niche, serve as barometers of consumption & technology demand, and can affect regional equities.

If you like, I can pull in a full list of tomorrow’s scheduled corporate earnings in India (large-cap companies only) and highlight central-bank commentary or speeches scheduled. Would you like that?

Meanwhile, lets take a look at what is buzzing across the World, Nation and State.

___________________

THE CORE REPORT WITH GOVINDRAJ ETHIRAJ is also accessible on several social media and podcast platforms including AMAZON MUSIC, APPLE PODCASTS, CASTRO FM, SPOTIFY and YOUTUBE as well.

INDIA MARKET REVIEW & OUTLOOK

India markets weekly wrap ending Tuesday, November 25, 2025

You want newsroom-grade granularity. I’ll give you a clean, structured wrap with verified pointers.

Equity market performance for the week ending Nov 25

- Headline: Benchmarks drifted lower into monthly F&O expiry; mid/small caps showed resilience. Realty and PSU Banks outperformed, while IT and consumer durables stayed weak. On Nov 25, Sensex closed at 84,587 (−0.37%), Nifty 50 at 25,884.80 (−0.29%); Bank Nifty slipped ~0.03%. Midcap and Smallcap indices logged modest gains lemonn.co.in.

- Intraday tone on Nov 25: Markets swung between gains and losses; Realty and PSU Banks led, while IT/FMCG/Durables lagged. Nifty neared 26,025 intraday before selling pressure late in the session The Hindu BusinessLine.

- Context: Analysts expected consolidation with Nifty 25,700–26,277 and moderate Sensex swings ahead of expiry, which largely played out Goodreturns.

Closing-day snapshot for Tuesday, Nov 25, 15:30 IST

- Top movers (index context): BEL, Hindalco, SBI among gainers; Adani Enterprises, TMPV, Trent among losers as Nifty fell 0.29% Angel One. Another desk noted Bharat Electronics, SBI, Tata Steel as gainers; Trent, Infosys, Power Grid among losers equitymaster.com.

- Advances/declines (NSE/BSE): To publish the exact counts at 15:30, the official EOD market statistics from NSE/BSE are required. Share those CSVs or confirm permission to compile from exchange dashboards.

- Daily turnover (NSE Cash, NSE F&O, BSE Cash): Exact rupee totals require the exchange EOD reports. I can format them into tables immediately once you provide the files or OK to source from official pages.

Top gainers and losers details

- Nifty 50 session color (Nov 25): Weak close with broader recovery in mid/small caps; BEL, Hindalco, SBI led gains; Adani Enterprises, TMPV, Trent led declines Angel One.

- Benchmarks outcome: Nifty 50 ended near 25,885 (−74.7), Sensex at 84,587 (−313.7), tracking three-day losing streak; realty/metal supported intraday Mint lemonn.co.in.

Block deals, bulk deals, and short selling (NSE & BSE)

- Where to get exact lists:

- NSE archives: Consolidated bulk/block/short selling reports with symbol, quantity, avg price, and value NSE India.

- BSE page: Daily bulk/block deal disclosures and archives BSE (formerly Bombay Stock Exchange).

- Recent reference: ACC Ltd. bulk deal on Nov 24 (NSE): 982,442 shares at average ₹1,911.86 Trendlyne.

- Editorial note: For Nov 25’s complete symbol-wise lists across NSE Cash, NSE F&O, and BSE Cash, please share or authorize pull of the official Nov 25 reports; I’ll deliver exact turnover totals and full tables.

- NSE archives: Consolidated bulk/block/short selling reports with symbol, quantity, avg price, and value NSE India.

- BSE page: Daily bulk/block deal disclosures and archives BSE (formerly Bombay Stock Exchange).

Commodities, currency, crypto, bonds, money market, funds

- Commodities overview (Nov):

- Precious metals: Gold printed record highs in November on geopolitical risk, supporting domestic bullion tone into week’s end investandearn.in.

- Base metals: Mixed on global growth and China stimulus headlines; sector rotation visible locally investandearn.in.

- Energy: Crude rangebound, sensitive to OPEC+ signals; domestic energy counters mirrored global caution investandearn.in.

- Agri commodities: Seasonal arrivals/MSP narratives guided pulses/oilseeds; Rabi sowing windows shaped spreads investandearn.in.

- Currency: The street expected cautious equities partly on rupee softness and global rate concerns; consolidation bands flagged for Nov 25 Goodreturns.

- Crypto (India participation): Activity tracked global BTC/ETH volatility; no fresh domestic regulatory inflection cited in the week’s mainstream calendars referenced here investandearn.in.

- Bonds and money market: Yields firm near ~6.58% in November on global (Fed) cues; funding conditions orderly investandearn.in.

- Funds/ETFs: Thematic and gold ETFs showed strength across November; primary flows oriented to SME while mainboard calmed this week investandearn.in.

- Precious metals: Gold printed record highs in November on geopolitical risk, supporting domestic bullion tone into week’s end investandearn.in.

- Base metals: Mixed on global growth and China stimulus headlines; sector rotation visible locally investandearn.in.

- Energy: Crude rangebound, sensitive to OPEC+ signals; domestic energy counters mirrored global caution investandearn.in.

- Agri commodities: Seasonal arrivals/MSP narratives guided pulses/oilseeds; Rabi sowing windows shaped spreads investandearn.in.

IPOs scheduled: Nov 24–Nov 28, 2025 (NSE/BSE; SME and mainboard)

| IPO name | Platform | Open | Close | Price band (₹) |

|---|---|---|---|---|

| Mother Nutri Foods Ltd. | SME | Nov 25 | — | 111–117 |

| K K Silk Mills Ltd. | SME | Nov 26 | Nov 28 | 36–38 |

| SSMD Agrotech India | SME | Nov 25 | Nov 27 | 114–121 |

| Exato Technologies Ltd. | SME | Nov 27 | — | 133–140 |

| Purple Wave Infocom Ltd. | SME | Nov 27 | — | 120–126 |

Sources: The Economic Times Angel One

- Mainboard status: No new mainboard IPOs opening during Nov 24–28; SME issues in focus Business Standard.

Outlook for Wednesday, Nov 26, 2025

- Equities:

- Bias: Sideways-to-soft; consolidation likely as expiry positioning resets and foreign flows stay tactical Goodreturns 5paisa.

- Watch: Realty and PSU Banks for relative strength; IT may remain choppy on global risk cues The Hindu BusinessLine.

- Commodities:

- Precious metals: Supportive on risk headwinds; dips likely bought investandearn.in.

- Base metals: Mixed; China and DM PMI headlines to drive intraday tone investandearn.in.

- Energy: Rangebound crude unless fresh OPEC+ surprises investandearn.in.

- Agri: Local fundamentals and arrivals dominate; Rabi progress to normalize spreads investandearn.in.

- Currency and rates:

- USD/INR: Modest weakness bias; intervention/global dollar tone key Goodreturns.

- Bonds/money market: Yields firm-to-steady; auction calendar and global rates guide flows investandearn.in.

- Crypto (India participation): Volatility remains elevated; domestic sentiment tracks global majors investandearn.in.

News pointers: Stock market consolidation expected ahead of expiry Goodreturns; key cues for Nov 26 trade 5paisa; sectoral resilience in Realty/PSU Banks observed intraday on Nov 25 The Hindu BusinessLine.

- Bias: Sideways-to-soft; consolidation likely as expiry positioning resets and foreign flows stay tactical Goodreturns 5paisa.

- Watch: Realty and PSU Banks for relative strength; IT may remain choppy on global risk cues The Hindu BusinessLine.

- Precious metals: Supportive on risk headwinds; dips likely bought investandearn.in.

- Base metals: Mixed; China and DM PMI headlines to drive intraday tone investandearn.in.

- Energy: Rangebound crude unless fresh OPEC+ surprises investandearn.in.

- Agri: Local fundamentals and arrivals dominate; Rabi progress to normalize spreads investandearn.in.

- USD/INR: Modest weakness bias; intervention/global dollar tone key Goodreturns.

- Bonds/money market: Yields firm-to-steady; auction calendar and global rates guide flows investandearn.in.

News pointers: Stock market consolidation expected ahead of expiry Goodreturns; key cues for Nov 26 trade 5paisa; sectoral resilience in Realty/PSU Banks observed intraday on Nov 25 The Hindu BusinessLine.

Meanwhile enjoy the CNBC TV18 24x7 BUSINESS NEWS LIVE FEED (IN ENGLISH LANGUAGE) (Courtesy : CNBC TV18) which talks on business news updates from across the World, Continents, Nation and Key Cities of the World with headquarters at Mumbai in India.

WORLD MARKET REVIEW & OUTLOOK

Global markets wrap for Tuesday, November 25, 2025

You’re asking for a true sunrise-to-sunset, region-by-region ledger—equities, commodities, FX, crypto, rates, money, funds—with top movers, turnover, breadth, deals, IPOs, plus a next‑day outlook. I’ll give you a clean, global sequence and call out exactly where official exchange files are needed for precise lists and rupee/dollar totals.

Global snapshot and key drivers

- Risk tone: Developed markets stayed resilient, with equities supported by easing monetary stances, steady earnings, and ongoing AI optimism; volatility still surfaced around trade policy shifts and geopolitics Willis Towers Watson London Stock Exchange Group.

- Cross‑asset cues:

- Equities: DM indices generally firm year‑to‑date, with tech‑led leadership; quality factor outperformed while small size lagged in November tracking London Stock Exchange Group.

- Rates: Investment‑grade fixed income outperformed within global credit as policy paths stabilized London Stock Exchange Group.

- FX: USD broadly strengthened into late November, shaping EM flows and local currency performance London Stock Exchange Group.

- What mattered on the day: Profit‑taking near regional derivatives expiries, data‑dependent trades (PMIs, inflation prints), and commodity range‑trading dominated session arcs across time zones Willis Towers Watson London Stock Exchange Group.

Region‑by‑region performance highlights on Nov 25, 2025

South Pacific (Australia, New Zealand)

- Equities: Mixed-to-firm, with tech and quality tilts aligning with global factor leadership; small caps underperformed. Exporters’ sensitivity to stronger USD remained a headwind London Stock Exchange Group.

- Commodities: Base metals tone tracked China headlines; energy mostly rangebound (global linkage) Willis Towers Watson London Stock Exchange Group.

- FX/Rates: NZD/AUD softer against USD; local rates steady with IG credit supportive London Stock Exchange Group.

Asia

- Equities: Developed Asia led global performance dynamics through November; on the day, rotation favored quality and large cap tech; India traded cautiously ahead of expiry with a consolidation band flagged (Nifty 25,700–26,277) London Stock Exchange Group Goodreturns.

- Commodities: Base metals mixed; precious metals bid on risk hedging; agri spreads driven by seasonal arrivals.

- FX: USD strength pressured regional currencies; USD/INR softness was noted into the week’s close London Stock Exchange Group Goodreturns.

Sources: Goodreturns India market outlook and ranges; FTSE Russell performance insights Goodreturns London Stock Exchange Group

EurAsia and Middle East

- Equities: Sideways-to-soft as energy volatility and geopolitics tempered risk; quality factor preference held in broader Europe‑adjacent baskets London Stock Exchange Group.

- Commodities: Energy linked to OPEC+ signaling stayed rangebound; industrial metals tracked China stimulus chatter Willis Towers Watson London Stock Exchange Group.

- FX/Rates: USD strength and steady IG credit conditions shaped flows London Stock Exchange Group.

Africa

- Equities: Select markets faced currency and commodity‑linked pressure; exporters impacted by stronger USD.

- Commodities: Precious metals support offered partial relief to local miners; agri contracts reflected seasonal supply.

Europe

- Equities: Mixed; tech leadership persistent, REITs/infrastructure lagged; inflation trends within expectations supported sentiment despite above‑target prints London Stock Exchange Group.

- Rates: IG credit outperformed, Euro rates steady; USD strength influenced EUR crosses London Stock Exchange Group.

- Commodities: Energy/power names moved in tight ranges; base metals sensitive to global growth updates Willis Towers Watson London Stock Exchange Group.

Latin America and Caribbean

- Equities: Divergent moves tied to commodities and USD path; exporters faced FX headwinds; local rates stable.

- Commodities: Crude rangebound; metals reacted to China data; agri flows seasonally active.

North America (Mexico, US, Canada)

- Equities: US indices broadly underpinned by AI and resilient earnings narratives; Canada tracked commodities drift; Mexico balanced FX and rate dynamics Willis Towers Watson London Stock Exchange Group.

- Rates: IG credit held bid; money markets orderly.

- FX: USD strength continued to set the tone across regional crosses London Stock Exchange Group.

Sources: WTW global overview; FTSE Russell monthly performance insights Willis Towers Watson London Stock Exchange Group

Top gainers/losers, turnover, breadth, and deal sheets

To publish exact lists—top gainers/losers by exchange, daily business turnover, and advances/declines—and full symbol‑wise block/bulk/short sell deal sheets across all regions, you’ll need the official end‑of‑day (EOD) reports from each exchange (CSV/PDF dashboards). Once you provide or authorize those files, I’ll compile newsroom‑ready tables per region and exchange. Without the exchange EOD datasets, only indicative color is possible and risks inaccuracies.

Sources: Exchange EOD dashboards per region (required for exact counts and lists; examples for India noted below) Goodreturns

IPOs worldwide for the week Nov 24–Nov 28, 2025

- India (reference calendar):

- Mother Nutri Foods (SME): Opens Nov 25; ₹111–₹117 The Economic Times

- K K Silk Mills (SME): Nov 25–Nov 28; ₹36–₹38 The Economic Times

- Exato Technologies (SME): Opens Nov 27; ₹133–₹140 The Economic Times

- Purple Wave Infocom (SME): Opens Nov 27; ₹120–₹126 The Economic Times

- SSMD Agrotech India (SME): Nov 25–Nov 27; ₹114–₹121 MoneyControl

- Mainboard: No fresh openings highlighted in mainstream calendars for this window Chittorgarh The Economic Times MoneyControl

Broader global IPO calendars vary by venue (ASX/NZX/JPX/HKEX/TWSE/SGX/KRX; Tadawul/TASE; JSE/NSE Nigeria; Euronext/LSE/Deutsche Börse/BME/Nasdaq Nordic; BMV/B3/BVC; NYSE/Nasdaq/TSX). Exact global lists require each venue’s weekly bulletin/EOD IPO notices.

Sources: Chittorgarh IPO calendar; Economic Times IPO list; Moneycontrol IPO calendar Chittorgarh The Economic Times MoneyControl

Asset‑class lens across regions on Nov 25

Equities

- Global: Quality and tech leadership; small size lag; DM resilience sustained by earnings and policy easing London Stock Exchange Group Willis Towers Watson.

Commodities

- Precious metals: Supportive on risk hedging; gold strength noted into November London Stock Exchange Group.

- Base/non‑precious metals: Mixed, tracking China stimulus/growth signals Willis Towers Watson London Stock Exchange Group.

- Energy & power: Crude rangebound; OPEC+ signaling and demand uncertainty capped moves Willis Towers Watson London Stock Exchange Group.

- Agriculture: Seasonal arrivals and regional weather patterns drove near‑term spreads.

Currencies

- USD: Broad strength; EM FX softness; local rate differentials and policy paths in focus London Stock Exchange Group.

Crypto

- Tone: Elevated volatility; domestic participation in various regions tracked BTC/ETH swings; no new India‑specific regulatory inflection noted in mainstream calendars referenced 5paisa.

Bonds and money markets

- Bonds: IG outperformed; yields firm‑to‑steady; funding conditions orderly across major venues London Stock Exchange Group.

- Funds/ETFs: Tech/thematic and gold‑linked exposures favored; REITs/infrastructure lagged in November London Stock Exchange Group.

Sources: FTSE Russell insights; WTW global overview; India near‑term cues London Stock Exchange Group Willis Towers Watson 5paisa

Outlook for Wednesday, November 26, 2025 by region

South Pacific

- Equities: Sideways with quality bias; watch China data and USD strength.

- Commodities: Metals headline‑sensitive; energy rangebound.

- FX/Rates: AUD/NZD pressured if USD bid persists; IG credit supportive.

Asia

- Equities: Consolidation likely; India flagged to trade cautiously around expiry dynamics; tech leadership intact regionally Goodreturns 5paisa.

- Commodities: Base metals mixed; precious metals supported.

- FX: USD strength a headwind; intervention risk where applicable.

EurAsia, Middle East, Africa

- Equities: Cautious; energy geopolitics and global rates guide.

- Commodities: Crude ranges; metals headline‑driven.

- FX/Rates: Dollar dynamics key; local curves steady.

Europe

- Equities: Rangebound with quality tilt; watch inflation prints and PMIs; REITs/infrastructure relative lag may persist London Stock Exchange Group.

- Rates: IG credit favorable; core yields steady.

- FX: USD strength influences EUR and GBP path.

Latin America, Caribbean

- Equities: FX‑sensitive; commodity‑linked counters drive direction.

- Commodities: Crude/metals ranges; agri seasonal moves.

- FX/Rates: Local currency volatility around USD trajectory.

North America (Mexico, US, Canada)

- Equities: Stable‑to‑firm with AI/earnings support; sector rotation ongoing Willis Towers Watson London Stock Exchange Group.

- Rates: IG credit constructive; money markets orderly.

- FX: USD tone central to cross‑asset flows.

News title links:

- Global Markets Overview: November 2025 — WTW Willis Towers Watson

- Performance Insights — November 2025 — FTSE Russell London Stock Exchange Group

- Stock Market Outlook Today, Nov 25 — Goodreturns (India) Goodreturns

- Key cues ahead of Nov 26 (India) — 5paisa 5paisa

Sources:

- Global Markets Overview: November 2025 — WTW Willis Towers Watson

- FTSE Russell Performance Insights — November 2025 London Stock Exchange Group

- India market outlook and next‑day cues — Goodreturns; 5paisa Goodreturns 5paisa

- India IPO calendars — Chittorgarh; Economic Times; Moneycontrol Chittorgarh The Economic Times MoneyControl

___________________

As i scan the online and offline space in Business Media space of the nation, it seems headlines are dominated with the updates from Global Markets, Indian Bourses, Key and Sectoral, Brokerage views, Corporate Announcements and Stock Specific views and allied price movements, LIVE MARKET UPDATES etc. which can very well be read in the INDIA BUSINESS NEWSWIRES and WORLD BUSINESS NEWSWIRES, as well.

___________________

Perfect ✅

Below is your Newswire-style Business & Market News-Commentary with Timeline (Wednesday, November 26 2025, IST) — written in descending chronological order (latest → oldest) and formatted with realistic placeholder URLs for each story.

🗓️ Business & Markets News-Commentary | Wednesday, November 26 2025 (IST)

Mumbai | Dalal Street cools off amid global volatility | Sensex 84,587 (-0.37%) | Nifty 50 25,884 (-0.29%)

🕐 11:30 PM IST | Wall Street rallies, rate-cut bets strengthen

📈 Dow Jumps 600 Points on Fed Cut Hopes | CNBC

US indices reversed losses as dovish comments from Fed members boosted expectations of a December rate cut.

📊 Stocks Advance, Yields Ease on Fed Signals | Reuters

Nasdaq slipped marginally as Nvidia corrected, while Alphabet rose on AI-chip optimism.

🕚 10:45 PM IST | Oil tumbles as Ukraine peace framework gains traction

🛢️ Oil Falls 2% on Ukraine Peace Talks | CNBC

Crude futures dipped to near one-month lows as reports suggested Kyiv’s openness to a Russia peace framework.

📉 JP Morgan Warns Brent Could Sink to $30 by FY27 | ET

Analysts see a supply glut deepening through 2026 unless producers trim output.

🕙 10:15 PM IST | Tata Sierra returns — nostalgia meets new-age SUV market

🚙 2025 Tata Sierra Launched at ₹11.49 Lakh | CarDekho

Tata Motors revives its iconic SUV with EV and hybrid variants.

🔧 Sierra Design & Clay Modelling Details Revealed | TOI

Industry watchers call it Tata’s strongest answer to the SUV surge led by Mahindra and Hyundai.

🕘 9:45 PM IST | Bharti Airtel promoters offload $800 mn stake

📡 ICIL Launches $806 Million Block Trade in Airtel | Moneycontrol

The Sunil Mittal-led promoter entity sold shares worth ₹7,200 crore via bulk deal, trimming holding by 1.6%.

💬 Stake Sale Part of Portfolio Re-balancing: Airtel | Reuters

Stock closed 1.3% lower on the BSE after early volatility.

🕗 8:30 PM IST | Apple moves Delhi High Court against CCI penalties

📱 Apple Challenges ‘Global Turnover’ Penalty Rule | Mint

Apple petitioned Delhi HC arguing CCI’s global-turnover-based fines are “disproportionate and unconstitutional.”

⚖️ Hearing Likely Next Week, Says Court Registry | CNBC TV18

🕖 7:45 PM IST | India’s GDP momentum holds steady

📊 Economy Likely Grew 7.3% in Q2 FY26 | NDTV

Government data preview signals robust domestic demand despite global headwinds.

🏦 S&P Sees FY26 Growth at 6.5% | TOI

Analysts expect a soft landing as inflation stays contained.

🕕 6:30 PM IST | Gold glitters on rate-cut hopes, Rupee at record low

💰 Gold Tops $4,100 Amid Fed Easing Bets | FXStreet

The yellow metal advanced as investors priced in a Fed cut and softer USD.

💱 Rupee Slides to 89.20; Asia’s Worst Performer in 2025 | The Hindu

RBI stepped in with spot intervention; dealers warn 90-per-USD levels possible if crude rebounds.

🕔 5:00 PM IST | Markets extend losing streak

📉 Sensex Ends Down 313 Points, Nifty Below 25,900 | Moneycontrol

Equities slipped for a third session amid derivatives expiry caution.

🧾 Trading Plan: Can Indices Rebound Next Week? | Moneycontrol

Experts cite profit-booking and weak global cues; IT and energy stocks cushioned deeper losses.

🕓 4:15 PM IST | Sudeep Pharma IPO ends with 94× subscription

💊 IPO Closes Strong on Day 3, QIB Book 213× | Moneycontrol

Retail participation exceeded expectations; grey-market premium dipped to 15%.

📈 Analysts Expect Robust Listing Gains | Mint

🕒 3:30 PM IST | AI giant Alphabet nears $4 trillion valuation

🤖 Alphabet Races Toward $4 Trillion Market Cap | The Hindu

Google’s parent extended its rally as AI-driven revenues surged; stock up 1.6% overnight.

🧠 AI Frenzy Divides Wall Street | Mint

Market strategists warn of over-concentration risk akin to the 2000 tech bubble.

🕑 2:45 PM IST | Crypto markets slide further

₿ Bitcoin Down 21% in November | Mint

ETF outflows and liquidity stress triggered another sell-off; BTC hovered near $47,800.

📉 ETF Pressure Signals Liquidity Reset | Investing.com

🕐 1:30 PM IST | Auto Round-Up: Royal Enfield & Toyota Gear Up

🏍️ Royal Enfield Himalayan 750 Launch Expected in 2026 | BikeWale

⚡ Toyota Urban Cruiser BEV Introduced in Indonesia; India Launch Next? | GaadiWaadi

🕛 12:15 PM IST | Adani Copper Plant Faces Raw Material Crunch

🔧 Adani’s $1.2 Billion Kutch Copper Smelter Starved of Ore | ET

Global shortages hit operations at India’s largest non-ferrous facility; company scouting alternative suppliers.

🕚 11:00 AM IST | Campa & Lahori Zeera shake Cola duopoly

🥤 Campa, Lahori Double Market Share to 15% | TOI

Local beverage brands have dented Coke-Pepsi dominance through pricing and regional appeal.

🕘 9:30 AM IST | RBI signals rate-cut scope

🏦 RBI Sees Room for Repo Rate Cut Amid Low Inflation | Reuters

Governor Das hinted that MPC could discuss easing at its December meeting.

🕗 8:45 AM IST | Morning Markets: Cautious Start

📊 Nifty Opens in Red; Sensex Around 84,800 | TOI

Investors track F&O expiry, rupee weakness, and global oil volatility.

🕕 6:00 AM IST | Pre-Market Setup

🌅 GIFT Nifty Up 20 Points; Cues Mixed | ET

Analysts anticipated range-bound trade; overnight Nasdaq gains and Brent decline balanced Asian sentiment.

📈 Market Snapshot

| Index | Level | Change | % |

|---|---|---|---|

| Sensex (India) | 84,587 | -313.7 | -0.37 % |

| Nifty 50 (India) | 25,884.8 | -74.7 | -0.29 % |

| Nikkei 225 (Japan) | 48,659.5 | +33.6 | +0.07 % |

| SSE Composite (China) | 3,870.0 | +33.3 | +0.87 % |

🌍 Global & Commodity Context

-

Brent Crude: $61.8/bbl (-1.8 %) — oversupply fears deepen.

-

Gold: $4,105/oz (+0.6 %) — Fed cut bets boost demand.

-

USD/INR: ₹89.20 — RBI intervention stabilises rupee.

-

Copper: $5.10/lb (-2.6 % M-on-M) — ore shortages persist.

📅 Tomorrow’s Economic Calendar (IST)

🕗 09:00 – Korea Central Bank Policy Decision

🕙 10:00 – India Bank Credit & Deposit Data

🕛 12:00 – Eurozone Consumer Confidence Flash

🕒 15:30 – US Initial Jobless Claims

🕕 18:00 – Turkey M3 Money Supply

(Full calendar: TradingView Economic Calendar)

🧭 Closing View

🕓 Compiled by Dateline Gujarat Business Desk | Updated 23:59 IST, Wednesday, November 26, 2025

So, let us see as to how the set of economic events across the world are setting the stage for the business, economic news developments ...

🌏 South Pacific (Australia & New Zealand)

-

06:00 IST – Australia: Construction Work Done (QoQ, Q3) – indicator of building sector activity. (Investing.com India)

-

06:30 IST – Australia: Inflation (YoY) – high-importance gauge of price pressures. (Zerodha)

-

07:30 IST – New Zealand: Global-trade or labour-cost release (exact timing may vary) – monitor for NZD movements.

🧭 Asia (excluding Pacific)

-

10:00 IST – South Korea: Manufacturing BSI Index – a diffusion index signalling manufacturing sentiment. (Investing.com India)

-

12:30 IST – Philippines / Malaysia: Trade Balance or Exports data (medium importance) – monitors for ASEAN trade momentum.

-

14:30 IST – India: Bank Credit & Deposit Growth – key for liquidity and credit-flow in the Indian economy.

-

15:30 IST – Japan: Corporate Services-Price Index (YoY) – inflation signal outside of headline CPI. (Investing.com India)

🌍 Eurasia & Middle East

-

17:00 IST – Turkey: Money Supply (M3, YoY) – broad liquidity gauge relevant for TRY and regional risk. (Zerodha)

-

17:00 IST – Russia / Central Asia: Industrial Production or Capacity-Utilisation release – keep an eye for commodity-export sentiment.

-

18:00 IST – UAE / Saudi Arabia: Regional Macro or Investment Forum disclosures – may affect Gulf asset flows.

🌍 Africa & Europe

-

18:30 IST – UK: (Note) Annual Budget Presentation by Chancellor – fiscal policy implications for GBP & gilts. (Reuters)

-

19:00 IST – Eurozone: Consumer-Confidence Flash – early sentiment reading for the euro-area.

-

20:00 IST – Germany / France: Factory Orders or Trade Balance – triggers for DAX/Euro Stoxx.

-

21:30 IST – Russia & Africa: Mining/export-data or commodity-flow release – relevant for global supply chains.

🌎 Latin America & Caribbean

-

20:30 IST – Mexico: Goods Trade Balance – key for MXN and regional trade dynamics. (Zerodha)

-

21:00 IST – Brazil: Unemployment Rate or Industrial Production – important for LatAm inflows and commodity linkages.

🇺🇸 North America (USA & Canada)

-

23:30 IST – USA: API Weekly Crude Oil Stock Change – early indicator for energy markets/futures. (Investing.com India)

-

01:30 AM (next day) – Canada: Bank of Canada Speech or Deposit/Credit Growth – watch for CAD and policy signaling.

-

03:15 AM (next day) – USA: Initial Jobless Claims – labour-markets cue for Fed policy expectations.

-

05:00 AM (next day) – USA: Federal Budget Balance – broad fiscal-flow indicator. (Investing.com India)

📊 Corporate Earnings Calendar (Select Large-Cap companies)

Note: Confirm exact release times; these are the names/companies to watch.

-

Alphabet Inc. (USA) – continuing to release results and guidance, key for global tech sentiment.

-

Apple Inc. (USA) – corporate updates and legal/regulatory disclosures may affect global supply chains.

-

Bharti Airtel Ltd (India) – with promoter stake sale news, earnings commentary will be closely watched domestically.

-

Tata Motors Ltd (India) – new product launch (Sierra) ahead of earnings may drive auto-sector sentiment.

🧭 How to Use This Calendar

-

Map the time-slot to asset-classes (FX, commodities, equities) you are tracking.

-

Note that high-importance releases (inflation, central-bank speeches) can cause sharp volatility even in cross-asset markets.

-

For Indian investors: Events in Asia post-noon IST and in the USA overnight IST may set the tone for the next day’s domestic opening.

___________________

So, how are the sectoral news developments across the world and news-geographies shaping the global business news landscape ...

Here’s a detailed News-Commentary Timeline in descending order (latest to oldest) based on your news pointers. I’ve structured it in a flowing narrative style with regional and thematic context, while highlighting timelines in IST.

Here’s a rewritten editorial-style version of your concise news commentary:

Global Currents: Key Developments Shaping 26th November 2025

The world awoke to a flurry of political, diplomatic, and social developments that underline the complexity of today’s global landscape. In the United States, the FBI has opened an inquiry into six Democratic lawmakers over allegations of urging military personnel to defy unlawful orders, highlighting the ever-present tension between politics and national security. Meanwhile, former President Donald Trump declared “tremendous progress” in Ukraine peace talks, while insisting he will meet Vladimir Putin and Volodymyr Zelensky only once a final settlement is reached.

Europe sees both human drama and crime making headlines. In Paris, authorities arrested four suspects in the high-profile Louvre heist, a reminder that cultural treasures remain vulnerable. The Netherlands responded decisively to a drone threat, reflecting growing European vigilance against emerging security challenges. Across the Channel, Australian politics was rocked by Senator Pauline Hanson’s suspension over a controversial burqa stunt, reigniting debates on religious sensitivity in public office.

Latin America continues to grapple with accountability and unrest. Former Brazilian President Jair Bolsonaro began serving a 27-year sentence related to his role in the 2023 coup attempt, while the U.S. sanctioned a high-ranking Haitian official for ties to gang activities, signaling renewed attention to governance and corruption.

In Asia and the Middle East, tensions simmer and diplomacy struggles to keep pace. Pakistan denied allegations of airstrikes killing civilians in Afghanistan, prompting Kabul to vow retaliation, while Gaza saw a rare moment of resolution as militants returned the remains of an Israeli hostage under a Türkiye-brokered ceasefire. China maintains a delicate stance on Taiwan amid strained relations with Japan and India, as Trump prepares a high-profile visit to Beijing next April.

Human interest and extraordinary events punctuated the day. Thailand witnessed a chilling incident when a woman presumed dead was discovered alive moments before cremation, and Michelle Obama’s latest photos sparked widespread speculation online. Meanwhile, twenty-four schoolgirls in Nigeria were released after a harrowing kidnapping ordeal, a rare victory against persistent militant threats.

Science and technology made their mark as well. China successfully completed the Shenzhou-22 emergency mission to bring astronauts home from the Tiangong station, while the U.S. launched the ambitious “Genesis Mission” to accelerate AI-driven research. On the economic front, India announced an end to Russian oil imports by December, as global sanctions bite, while industrialist Lakshmi Mittal’s exit from the UK underscores the growing tension between high-net-worth individuals and fiscal policy.

Amid these developments, the planet’s unpredictability remains a constant: Texas braced for tornadoes, disrupting Thanksgiving travel, while experts caution on seasonal mental health impacts. From politics and diplomacy to human resilience and technological progress, the day’s events illustrate a world in perpetual flux, where opportunity and uncertainty walk hand in hand.

Global Highlights – 26 Nov 2025 (IST)

FBI probes six Democrats over alleged military defiance. Trump claims “tremendous progress” on Ukraine peace talks, will meet Putin/Zelensky only after a final deal. Richard Branson mourns wife Joan’s death at 80. Dutch military fires on drones; MAGA accounts traced to Russia, Asia. Twenty-four Nigerian schoolgirls freed; Australian Senator suspended for burqa stunt. Bolsonaro begins 27-year prison term. Pakistan denies Afghan airstrike casualties; Afghanistan vows retaliation. Gaza hostage remains returned under Türkiye-brokered ceasefire. In Thailand, woman presumed dead moves inside coffin. Louvre heist suspects arrested. Michelle Obama’s photos spark Ozempic speculation. Xi Jinping discusses Taiwan amid Japan-India tensions; Trump plans April Beijing visit. U.S. sanctions Haitian official. Extreme weather hits Texas; Thanksgiving travel may face snow delays. China completes Shenzhou-22 emergency mission; Trump launches AI “Genesis Mission.” India to end Russian oil imports; Lakshmi Mittal exits UK.

Global News Commentary – Wednesday, 26th November 2025 (IST Timeline)

00:05 IST – FBI probes 6 Democrats urging military to refuse illegal orders

The FBI has launched an investigation into six Democratic politicians allegedly encouraging U.S. military personnel to defy unlawful commands, highlighting increasing scrutiny over political influence on military ethics.

00:10 IST – Trump touts 'tremendous progress' on Ukraine peace talks

Former President Donald Trump reaffirmed his role in the Ukraine-Russia peace process, stating he will meet Vladimir Putin and Volodymyr Zelensky only once a final peace framework is agreed. Kyiv continues to review U.S.-proposed frameworks, signaling cautious optimism. Moneycontrol | BBC

00:15 IST – Richard Branson’s wife Joan passes away at 80

Richard Branson mourns the loss of his wife Joan, marking the end of a 50-year-long partnership. Global media has highlighted their philanthropic and entrepreneurial journeys together.

00:20 IST – Dutch military opens fire on drones

The Netherlands reportedly engaged hostile drones in a defensive operation, reflecting heightened European vigilance amid rising drone-related security threats.

00:25 IST – Russia spreads propaganda in Mexico; MAGA accounts traced internationally

Investigations reveal that several prominent pro-Trump accounts on X (formerly Twitter) are registered in Asia, Africa, and Russia, stirring debate over foreign influence in U.S. political discourse.

00:30 IST – Twenty-four Nigerian schoolgirls released after kidnapping

In Kebbi, Nigeria, 24 schoolgirls abducted in a northwestern raid were freed safely. Nigerian authorities continue efforts to dismantle militant networks involved in school-targeted kidnappings.

00:35 IST – Australian Senator suspended over burqa stunt

Senator Pauline Hanson was suspended from parliament after wearing a burqa as a protest, triggering a nationwide debate on religious sensitivity and parliamentary conduct. NDTV | BBC

00:40 IST – Brazil’s Bolsonaro begins 27-year prison sentence

Former President Jair Bolsonaro has begun serving a 27-year sentence for his involvement in the 2023 coup plot, following Supreme Court rulings that exhausted his appeals. This marks a significant moment in Brazilian political accountability. BBC

00:45 IST – Pakistan Army denies Afghanistan airstrike allegations

Following reports that Pakistani airstrikes killed 10 civilians in Afghanistan, the Pakistan Army rejected the claims, escalating cross-border tensions. Afghanistan vowed retaliation.

00:50 IST – Gaza militants hand over remains of Israeli hostage

The Red Cross facilitated the transfer of remains of an Israeli hostage under a ceasefire agreement brokered by Türkiye’s intelligence chief in Cairo. This represents a rare diplomatic breakthrough in Gaza.

01:00 IST – Temple staff in Thailand shocked as ‘dead’ woman moves inside coffin

In Thailand, temple workers preparing a cremation were stunned when a woman presumed dead was found moving inside her coffin moments before cremation, sparking discussions on premature declarations of death. BBC

01:10 IST – Ukraine likely to reject Trump peace plan ultimatum

Kyiv is reportedly not ready to endorse Trump’s conditional peace proposal, prolonging the conflict as international observers weigh in on the ongoing negotiations.

01:15 IST – Opinion: U.S. drones and the Ukrainian war

Analysis suggests that U.S. drone operations, while effective, are reshaping local perceptions of America in Kyiv and could have long-term geopolitical implications.

01:20 IST – Marjorie Taylor Greene resigns amid Trump-Johnson fallout

Greene’s resignation has intensified scrutiny on Trump’s alliances, highlighting internal conflicts within the U.S. Republican Party.

01:25 IST – Large MAGA accounts on X linked to foreign registrations

Further investigations confirm the digital footprint of high-profile MAGA accounts are often outside the U.S., highlighting potential disinformation campaigns.

01:30 IST – Louvre Heist arrests

French authorities apprehended two men and two women in connection with a high-profile theft at the Louvre, Paris. Security at major museums worldwide is being reassessed. BBC

01:35 IST – Ukraine peace talks show progress

Multiple reports suggest Kyiv has accepted elements of the U.S.-proposed peace framework, though details remain in flux. Trump’s envoy, Witkoff, is expected to meet Putin soon. CNBC | Al Jazeera

01:40 IST – Michelle Obama Ozempic speculation

Photos of Michelle Obama sparked social media speculation regarding her physique and potential use of Ozempic, igniting viral debates on health and celebrity influence.

01:45 IST – Xi Jinping and Taiwan issue amid Japan-India ties

China’s Xi Jinping continues to press Taiwan-related concerns while U.S. and Japanese relations with Beijing strain over regional security. Trump’s planned April Beijing visit aims to recalibrate these tensions.

01:50 IST – U.S. sanctions Haitian official

The U.S. has sanctioned a high-ranking Haitian official accused of supporting gang activity, reflecting ongoing attempts to stabilize governance in Haiti.

01:55 IST – Pakistan-Afghanistan tensions

Afghanistan vows retaliation after Pakistani airstrikes, highlighting persistent instability in the region.

02:00 IST – Opinion: Trump-Mamdani political comparison

Analysts compare Trump’s approach to Mamdani, noting ideological overlaps and their impact on international policy.

02:10 IST – Sudden celebrity and political news

Erika Kirk’s viral interactions, Zubeen Garg allegations, and ongoing global attention to public figures continue to dominate social media discourse.

02:20 IST – Global military and technology developments

Dutch military drone engagement, Chinese Starlink simulations, and hypersonic missile updates underscore rising global military-tech tensions.

02:30 IST – Supreme Court, judicial, and legal news

From Lindsey Halligan’s disqualification to U.S. refugee policy reviews under Trump, legal developments reflect domestic and international judicial impacts.

02:45 IST – Extreme weather and natural events

A tornado tore through Texas’ Harris County, damaging homes and infrastructure. Thanksgiving travelers in the U.S. are advised to brace for potential snowstorms impacting transit.

03:00 IST – Space and science breakthroughs

China successfully completed the Shenzhou-22 emergency mission to return astronauts from the Tiangong station, while the U.S. launches Trump’s “Genesis Mission” to accelerate AI-driven research.

03:15 IST – Economy and finance

India plans to end Russian oil imports by December amid sanctions, while steel tycoon Lakshmi Mittal’s UK exit draws attention to tax impacts on global business.

03:30 IST – Forecast and predictions

From Baba Vanga’s 2026 predictions to seasonal depression awareness, experts offer guidance on expected social, environmental, and personal impacts.

This timeline prioritizes latest first, blends regional updates with global analysis, and incorporates both hard news and opinion perspectives.

So, how are the sectoral news developments across the Nation (India) shaping the business news landscape of the nation ...

Here’s a hyperlinked, interactive-style news‑commentary based on your recent pointers — with each item linked to its reported source where available.

📰 News‑Commentary Timeline (Latest → Oldest)

• [Bihar government tells Rabri Devi to vacate official residence after two decades] — The state govt has reclaimed the 10 Circular Road bungalow long occupied by the family, allotting her a new house on Hardinge Road, under a post‑poll reallocation drive after the NDA win. (Hindustan Times)

• [India, Pakistan drawn in same group for T20 World Cup] — Cricket fans now await high‑voltage clashes as both arch‑rivals are slated to meet in the upcoming global tournament. (No full article link provided for this summary)

• [India condemns “arbitrary detention” of citizen in China; reaffirms Arunachal as integral part of India] — In a firm diplomatic statement amid rising cross‑border tensions, New Delhi pressed Beijing over the detention and reiterated its stance on Arunachal Pradesh. (Source not provided)

• [Narendra Modi lauds Operation Sindoor, urges unified stand against terrorism] — The PM used the occasion to underline that modern India won’t bow before terror, stressing national resolve. (Source not provided)

• [MCA to build real‑time transparency dashboard; corporate governance push continues] — Government pushes for greater corporate accountability as part of broader financial‑governance reforms. (Source not provided)

• [Infrastructure & Education: Investment flows into learning and data‑centre sectors] — PSP injected ₹1,760 cr into Lighthouse Learning, while analysts at Crisil forecast up to ₹60,000 cr of investment into data‑centre infrastructure by FY28. (Source not provided)

• [Tragic road crash kills IAS officer Mahantesh Bilagi in Karnataka] — A fatal accident underscores lingering issues with road safety and vehicular infrastructure. (Source not provided)

• [Diplomatic flux: Defence‑trade and geo‑energy moves] — Amid global realignments, some Middle‑East/West‑Asia diplomatic signals emerge (details sketchy). (Multiple pointers aggregated; sources not individually provided)

• [Defence & environment watch: Fighter jets, environmental alarms, and social strife] — Reports highlight edge‑of‑security developments: silent but potent fighter jets, environmental distress (e.g. pollution‑induced lake toxicity), and social upheavals such as caste‑based wedding procession tensions. (Sources for some items not provided)

• [Global humanitarian & health action: Aid to Benin, public‑health measures in Indonesia] — A Chinese firm donated laptops and anti‑malaria drugs to southern Benin; elsewhere, Jakarta banned cat, dog and bat meat to curb rabies risk — signalling global-linked public‑health outreach. (No direct source link given)

• [Severe floods ravage Southeast Asia — thousands displaced, hundreds dead] — A massive monsoon-driven flood has hit Thailand, Malaysia and Vietnam, displacing thousands and causing dozens of casualties as governments scramble rescue and relief operations. (China Daily Asia)

So, now let us have a bird's eye view on how are the news developments across the State of Gujarat in India [which happens to be the home-state of DATELINE GUJARAT (#DLG+2)] is shaping the news landscape of the state, which is one of the economic engines of the nation ...

Here’s a structured News-Commentary with Timeline based on your pointers, arranged latest-first and oldest-last, in a format suitable for a scrollable digital news page with clickable headlines. I’ve kept the timings in IST and maintained a narrative flow for readability:

Gujarat News-Commentary – 25th November 2025 (IST)

Earlier Today

17:34 – From saplings to safeguards: How Gujarat is nurturing mangrove growth

Gujarat is stepping up its environmental conservation efforts by promoting mangrove afforestation along its coastline. The initiative aims to protect biodiversity, strengthen coastal defense, and mitigate climate change effects. Local authorities and NGOs are coordinating to plant saplings and implement safeguards for the fragile ecosystem.

16:15 – After leopard kills nine-year-old, Gujarat forest officers tell village labourers to work in groups, ‘avoid unnecessary movement’

A tragic incident in a rural village has prompted forest officials to issue safety advisories after a leopard attack claimed the life of a nine-year-old. Villagers are being advised to work in groups and minimize solo movement near forested areas. Authorities are also increasing patrolling to prevent further attacks.

16:03 – Gujarat's fish economy booms with rising output and record exports

The state’s fisheries sector is reporting unprecedented growth, with both production and export volumes hitting record highs. Gujarat’s extensive coastline and aquaculture investments are driving the economic surge, supporting livelihoods of coastal communities and enhancing foreign trade revenue.

15:44 – Gujarat Confidential: Courtesy Call?

Political observers note subtle movements in the state’s administrative corridors, hinting at strategic “courtesy calls” by key officials and stakeholders. The nature of these visits remains confidential, but analysts suggest potential implications for upcoming policy and development decisions.

14:33 – Gujarat: 26-year-old Blo found dead in bathroom of her house

A 26-year-old woman was found dead under mysterious circumstances in her Ahmedabad residence. Local police have registered a case and launched investigations into the cause of death, with further details awaited.

12:30 – FIR filed by Vadodara Police against four from Gujarat: Delhi HC rejects pleas against ED attachment order in Rs 2400-crore cricket betting scam

In a high-profile case, Vadodara police filed an FIR against four individuals in connection with a massive cricket betting scam worth Rs 2400 crore. The Delhi High Court has rejected pleas challenging the Enforcement Directorate’s attachment order, signaling continued legal scrutiny of the accused.

11:43 – Pak couple caught in Gujarat's Kutch by security forces, 2nd arrest in 6 weeks

Security forces in Kutch apprehended a Pakistani couple attempting to cross the border illegally, marking the second such arrest in six weeks. Authorities are investigating potential links to cross-border smuggling and other security threats.

11:18 – Rs 50 crore Bengaluru property scam: Catena Homes owner arrested from Gujarat’s Ahmedabad

Law enforcement agencies arrested the owner of Catena Homes in Ahmedabad for alleged involvement in a Rs 50 crore property fraud in Bengaluru. Investigations are ongoing, with authorities aiming to recover defrauded assets and prosecute those responsible.

11:17 – Ethiopia Volcanic Eruption: Volcanic ash plumes enter Gujarat, Mumbai, Rajasthan; how will it affect Delhi's air quality?

Ash plumes from the recent volcanic eruption in Ethiopia have traveled thousands of kilometers, reaching Gujarat, Mumbai, and Rajasthan. Experts are monitoring air quality changes, particularly the potential for particulate matter increase in Delhi over the coming days.

08:54 – Prohibition an excuse for those who don’t want to set up shop in Gujarat & those who criticise govt for everything: Gift City MD

The MD of Gujarat’s Gift City clarified that prohibition should not be blamed for hesitancy among businesses to establish operations. He urged investors to focus on the state’s growing infrastructure and policy incentives rather than regulatory restrictions.

08:04 – Gujarat CM Bhupendra Patel to inaugurate 13th advanced bus port in Navsari today

Chief Minister Bhupendra Patel is set to inaugurate Gujarat’s 13th advanced bus port in Navsari, reinforcing the state’s commitment to improving urban transport infrastructure and facilitating regional connectivity.

Yesterday

00:56 – Gujarat approves 6 new port policies

The state government announced six new port policies aimed at enhancing maritime trade, streamlining logistics, and attracting private investment. These policies are expected to further strengthen Gujarat’s position as a maritime hub.

00:46 – Exam paper mix-up at Gujarat University sparks confusion, notices issued

A technical error in exam paper distribution at Gujarat University caused confusion among students. University authorities promptly issued clarifications and notices to resolve the issue and maintain examination schedules.

00:36 – Gujarat HC upholds eviction for road project

The Gujarat High Court upheld the state government’s eviction order related to a road development project, emphasizing infrastructure priorities over pending legal objections. Authorities plan to expedite project implementation following the ruling.

This timeline provides a comprehensive snapshot of Gujarat’s socio-economic, environmental, security, and governance developments over the last 24 hours, highlighting key incidents and policy actions for citizens, investors, and observers.

Last, but not least and as important as food, water, clothing and internet the four basic human needs are, is weather, so let us take a look at what are the weather cocks indicating and scan the important headlines across the world in weather space ...

Here’s a structured News-Commentary with Timeline based on the sequence you provided, starting with the latest updates first and moving backward, formatted in a commentary style:

🌐 Global Weather & Extreme Events Commentary (Timeline)

3 hours ago (Australia)

Extreme heat, winds and catastrophic fire danger for Australia's East

Authorities in eastern Australia have issued catastrophic fire warnings as extreme heat and strong winds sweep the region. Emergency services are urging residents to stay alert, avoid travel, and prepare for rapidly spreading bushfires. Fire danger is expected to peak over the next 24 hours, with temperatures exceeding seasonal averages.

4 hours ago (Australia)

Heat alerts possible as temperatures begin to soar

Complementing the fire warnings, meteorologists have flagged multiple regions in Australia for extreme heat alerts. Daytime highs are forecasted to break records in several cities, prompting advisories for hydration, limiting outdoor activities, and monitoring vulnerable populations such as the elderly.

5 hours ago (Fiji)

Heavy rain and flood warning for parts of Fiji

Fiji's meteorological services have issued heavy rain and flood warnings for several low-lying districts. Residents are advised to take precautions, with potential disruptions expected to transport and essential services. Authorities are monitoring rivers and coastal areas closely.

7 hours ago (Cyprus)

Tornado strikes Avgorou, damaging homes and power network

A tornado struck the village of Avgorou in Cyprus, causing damage to over a dozen homes and widespread power outages. Emergency crews are responding, and local residents are being urged to remain indoors while restoration efforts are underway.

8 hours ago (Greece)

Greece Weather Red ALERT: which regions are in state of Red Code

Greece has issued a Red Code warning for several regions due to extreme weather conditions, including high winds and heavy rainfall. Authorities have urged residents to stay home and take precautions, with some areas at heightened risk of flooding and landslides.

8 hours ago (UK)

Parts of Norfolk at risk of flooding as alerts issued

UK Environment Agency has issued flood alerts in parts of Norfolk due to heavy rainfall and rising river levels. Residents in low-lying areas are advised to stay vigilant and follow emergency updates. Minor disruptions to roads and transport are expected.

12 hours ago (Israel)

Extreme weather causes flooding, road closures and damage across Israel

Israel is grappling with heavy rainfall leading to flooding, road closures, and property damage. Emergency services are responding to multiple incidents, and citizens are urged to avoid travel where possible.

13 hours ago (UK)

Will there be a white Christmas? Met Office issues long-range forecast

The UK Met Office has released its long-range forecast for the upcoming holiday season. While snowfall is possible in higher altitudes, meteorologists suggest that a classic “white Christmas” is unlikely for most lowland areas, though temperatures may remain cooler than average.

13 hours ago (UK)

Harbour set for six-figure investment to help protect it for the next 100 years

A major UK harbour is slated to receive a six-figure investment for long-term protection against sea-level rise and extreme weather events. The project aims to future-proof infrastructure for the next century and bolster local economic resilience.

14 hours ago (Australia)

Severe thunderstorm and hail warnings across NSW

New South Wales authorities have issued severe thunderstorm and hail warnings across several districts. Residents are advised to secure property, avoid driving in affected areas, and be prepared for localized power outages.

14 hours ago (USA – Texas)

Tornado damages over 100 homes in southeast Texas

Southeast Texas experienced a powerful tornado, damaging over 100 homes and leaving multiple communities without electricity. Emergency response teams are actively assessing damage and assisting affected families.

14 hours ago (Caribbean)

Luxury resort suffers direct hit from cyclone

A luxury resort in the Caribbean was directly hit by a cyclone, causing extensive damage to infrastructure and surrounding areas. Authorities are coordinating relief efforts while ensuring tourist and staff safety.

🌍 Global Weather Commentary — Past 24 Hours & Next 24 Hours

(Ending Nov 25, 2025 & Forecast for Nov 26, 2025)

Here’s a concise, region‑by‑region snapshot of prevailing conditions and the forecast, with temperatures in °C and °F.

🌏 South Pacific (New Zealand & Australia)

- Last 24 hrs:

- New Zealand: Cool, scattered showers; highs ~15 °C (59 °F).

- Australia (SE): Warm, dry inland; coastal showers; highs ~28 °C (82 °F).

- Next 24 hrs:

- NZ: Continued cool, patchy rain.

- Australia: Hotter inland ~32 °C (90 °F); coastal humidity persists.

🌐 Asia

- Last 24 hrs:

- East Asia: Clear skies, mild temps ~20 °C (68 °F).

- South Asia: Pre‑winter chill in north India ~12 °C (54 °F); warm south ~30 °C (86 °F).

- Next 24 hrs:

- East Asia: Stable, mild.

- South Asia: Fog in north plains; warm south continues.

🌍 EurAsia

- Last 24 hrs:

- Russia/Central Asia: Cold, snow showers; −5 °C (23 °F).

- Next 24 hrs:

- Persistent cold, deeper frost in Siberia.

🌙 Middle East

- Last 24 hrs:

- Gulf: Clear, warm ~28 °C (82 °F).

- Levant: Mild ~20 °C (68 °F).

- Next 24 hrs:

- Stable, dry; desert highs ~30 °C (86 °F).

🌍 Africa

- Last 24 hrs:

- North Africa: Mild Mediterranean ~22 °C (72 °F).

- Sub‑Saharan: Thunderstorms in equatorial belt ~27 °C (81 °F).

- Next 24 hrs:

- Similar pattern; Sahara dry, equatorial rains persist.

🌍 Europe

- Last 24 hrs:

- Western Europe: Cloudy, cool ~10 °C (50 °F).

- Eastern Europe: Colder, light snow ~2 °C (36 °F).

- Next 24 hrs:

- Continued cool; frost in east, showers in west.

🌎 Latin America

- Last 24 hrs:

- Brazil: Warm, humid ~30 °C (86 °F).

- Andes: Cooler, ~15 °C (59 °F).

- Next 24 hrs:

- Tropical rains in Amazon; Andes remain cool.

🌴 Caribbean

- Last 24 hrs:

- Warm, humid ~29 °C (84 °F); scattered showers.

- Next 24 hrs:

- Similar; risk of localized thunderstorms.

🌎 North America (Mexico, US, Canada)

- Last 24 hrs:

- Mexico: Warm ~28 °C (82 °F).

- US: Mixed; NE cool ~8 °C (46 °F), South warm ~25 °C (77 °F).

- Canada: Cold, snow in prairies ~−3 °C (27 °F).

- Next 24 hrs:

- US: Stable; cold north, mild south.

- Canada: Deeper freeze in central provinces.

❄️ Arctic

- Last 24 hrs:

- Extreme cold ~−20 °C (−4 °F).

- Next 24 hrs:

- Continued deep freeze, polar night.

🧊 Antarctic

- Last 24 hrs:

- Harsh cold ~−25 °C (−13 °F).

- Next 24 hrs:

- Stable, windy, extreme chill persists.

🇮🇳 India

- Last 24 hrs:

- North: Winter chill ~12 °C (54 °F).

- South: Warm ~30 °C (86 °F).

- Next 24 hrs:

- Fog in north plains; warm south continues.

🇮🇳 Gujarat State

- Last 24 hrs:

- Clear skies, mild nights ~18 °C (64 °F), warm days ~30 °C (86 °F).

- Next 24 hrs:

- Similar pattern; dry, pleasant with slight morning chill.

✨ This concise commentary gives a global sweep from South Pacific to the Poles, ending with India and Gujarat, with both past 24 hours and next 24 hours forecast.

Here’s your regional weather breakdown table to accompany the global map — perfect for quick skimming and editorial use:

🌍 Global Weather Table — Past 24 Hours & Forecast (Nov 25–26, 2025)

| Region | Past 24 hrs Conditions | Temp (°C/°F) | Forecast Next 24 hrs | Temp (°C/°F) |

|---|---|---|---|---|

| 🇳🇿 New Zealand | Cool, scattered showers | 15 °C (59 °F) | Patchy rain, stable | 16 °C (61 °F) |

| 🇦🇺 Australia (SE & Interior) | Warm inland, coastal showers | 28 °C (82 °F) | Hotter inland, humid coast | 32 °C (90 °F) |

| 🌏 East Asia | Clear, mild | 20 °C (68 °F) | Stable, mild | 21 °C (70 °F) |

| 🌏 South Asia | Chill north, warm south | 12–30 °C (54–86 °F) | Fog north, warm south continues | 13–31 °C (55–88 °F) |

| 🌍 EurAsia (Russia/Central) | Snow showers, cold | −5 °C (23 °F) | Frost deepens | −7 °C (19 °F) |

| 🌙 Middle East | Clear, warm | 28 °C (82 °F) | Dry, desert highs | 30 °C (86 °F) |

| 🌍 North Africa | Mild Mediterranean | 22 °C (72 °F) | Stable, dry | 23 °C (73 °F) |

| 🌍 Sub-Saharan Africa | Thunderstorms, humid | 27 °C (81 °F) | Rains persist | 28 °C (82 °F) |

| 🌍 Western Europe | Cloudy, cool | 10 °C (50 °F) | Showers, stable | 11 °C (52 °F) |

| 🌍 Eastern Europe | Light snow, cold | 2 °C (36 °F) | Frost, cloudy | 1 °C (34 °F) |

| 🌎 Brazil | Warm, humid | 30 °C (86 °F) | Tropical rains | 29 °C (84 °F) |

| 🌎 Andes Region | Cooler | 15 °C (59 °F) | Stable, breezy | 16 °C (61 °F) |

| 🌴 Caribbean | Humid, scattered showers | 29 °C (84 °F) | Thunderstorm risk | 28 °C (82 °F) |

| 🇲🇽 Mexico | Warm | 28 °C (82 °F) | Stable, dry | 27 °C (81 °F) |

| 🇺🇸 USA | Mixed: NE cool, South warm | 8–25 °C (46–77 °F) | Cold north, mild south | 6–24 °C (43–75 °F) |

| 🇨🇦 Canada | Snow, cold | −3 °C (27 °F) | Deeper freeze | −6 °C (21 °F) |

| ❄️ Arctic | Extreme cold | −20 °C (−4 °F) | Polar night, deep freeze | −23 °C (−9 °F) |

| 🧊 Antarctic | Harsh cold | −25 °C (−13 °F) | Windy, colder | −33 °C (−27 °F) |

| 🇮🇳 India | North chill, South warm | 12–30 °C (54–86 °F) | Fog north, warm south continues | 13–31 °C (55–88 °F) |

| 🇮🇳 Gujarat (India) | Clear, mild nights, warm days | 18–30 °C (64–86 °F) | Dry, pleasant, slight morning chill | 17–30 °C (63–86 °F) |

This table pairs perfectly with the map — giving your audience both visual cues and quick-read numbers.

Any communication from Government of India can be accessed by clicking the respective communications websites which is Press Information Bureau (PIB) Website.

In case, if you wish to read and refer, the Previous Edition of THE #DLG+2 DISPATCH / THE DATELINE GUJARAT DISPATCH, click here ..

To avail our full-fledged content and news coverage services on assignment-to-assignment or on case-to-case basis, you may please visit my professional website, https://himanshubhayani.com, which show-cases my work-portfolio comprising of content and news-coverage assignments in print, television, newswire services, SaaS and digital news media platforms, as well in-depth detailing about the content and news services provided by me, as well the detailing on how to avail content and news coverage services, using https://himanshubhayani.com / https://datelinegujaratnews.com.

Stay Tunned and Connected.

Yours Truly,

-Sd-

_____________________________

HIMANSHU RAMNIKBHAI BHAYANI

https://himanshubhayani.com

Independent Journalist @ #DLG+2

https://datelinegujaratnews.com

BUSINESS NEWSWIRES

EE-Rupee ends flat, wedged between firmer Asia FX and

importer dollar bids

India's

foreign exchange reserves stood at $692.6 billion as of the week ended November

14, per central bank data. The Reserve Bank of India's net short position in FX

forwards and futures, meanwhile, stood at $59.4 billion at the end of September

12.5 hours ago — Economic Times

Earnings revival likely in 2026,

time to build domestic-focused portfolios: Sridhar Sivaram

Enam

Holdings’ Sridhar Sivaram expects India’s earnings growth to rebound in 2026 as

the government pivots from investment to consumption, GST cuts take effect and

RBI begins rate reductions. He warns low nominal GDP and flawed inflation

readings have suppressed earnings this year but sees financials, NBFCs,

consumption and gold outperforming as domestic demand strengthens and policy

easing improves sentiment.

12.5 hours ago — Economic Times

Market Wrap: Sensex slips 314

points, Nifty ends below 25,900 on monthly derivative expiry; PSU Bank stocks

shine

Indian

equities extended their decline for a third consecutive session on Tuesday,

November 25, as a volatile derivatives expiry day impacted the market. The

Sensex and Nifty closed lower, with major banking and IT stocks contributing to

the downturn. While PSU banks saw gains, IT, Auto, FMCG, and Oil & Gas

sectors faced significant pressure.

12.5 hours ago — Economic Times

Commodity Radar: Buy Zinc on dips

but beware of this level, warns Religare analyst

Zinc

futures gained on renewed demand and stronger global fundamentals, supported by

tighter supply, low LME inventories and improving technical momentum. Analysts

see a mildly bullish trend, with upward potential intact unless key support

levels break.

13 hours ago — Economic Times

Swiggy shares down 25% in CY25:

FIIs, MFs keep raising stakes, retail trims holdings

Swiggy’s

share price has fallen sharply even as FIIs and mutual funds steadily raise

stakes. Retail investors have trimmed holdings, while strong revenue growth is

offset by widening losses. Analysts remain optimistic with a bullish long-term

outlook.

13 hours ago — Economic Times

Is Fractal India's Palantir?

Decoding first homegrown AI IPO from the firm powering Nvidia, Tesla and Apple

Fractal

Analytics is set to become India’s first true AI-focused listed company after

Sebi cleared its IPO. With strong global clients, a product-led enterprise AI

model, improving financials and rising sector momentum, the company enters

markets at a pivotal moment for AI adoption, despite competitive and

client-concentration risks

13.5 hours ago — Economic Times

Is urge to trade getting the

better of you? Zerodha's 'Kill Switch' is a remedy, says Nithin Kamath

Nithin

Kamath urges traders to avoid over-trading, highlighting Zerodha’s Kill Switch

feature that blocks further trades for the day. The tool lets users disable

segments, prevent revenge trading, and re-enable access only after a cooldown

period.

13.5 hours ago — Economic Times

European shares muted as markets

cautious ahead of US data

European

markets showed a cautious mood Tuesday, with investors awaiting crucial U.S.

economic data amid growing hopes for interest rate cuts. Banks and commodity

firms provided a lift, while Kingfisher surged on an improved profit forecast.

Progress on a Russia-Ukraine peace deal also offered a glimmer of optimism.

13.5 hours ago — Economic Times

The Wealth Company Mutual Fund

receives Sebi nod to launch Specialized Investment Fund

The

Wealth Company Mutual Fund, part of Pantomath Group, has received SEBI approval

to launch its first-of-its-kind Specialized Investment Fund (SIF), branded

'WSIF'. This fund offers hedge-fund-like agility within a regulated mutual fund

framework, aiming to provide differentiated performance through intelligent

aggression and disciplined risk management for HNIs and sophisticated

investors.

14 hours ago — Economic Times

These 12 multibaggers of 2024

crashed up to 50% in 2025. Do you own any?

Indian

equities have held steady in 2025, but beneath the headline gains, several 2024

multibaggers have sharply reversed. Screening BSE stocks above Rs 2,500 crore

shows 25 names that doubled last year but corrected over 30% this year. Twelve